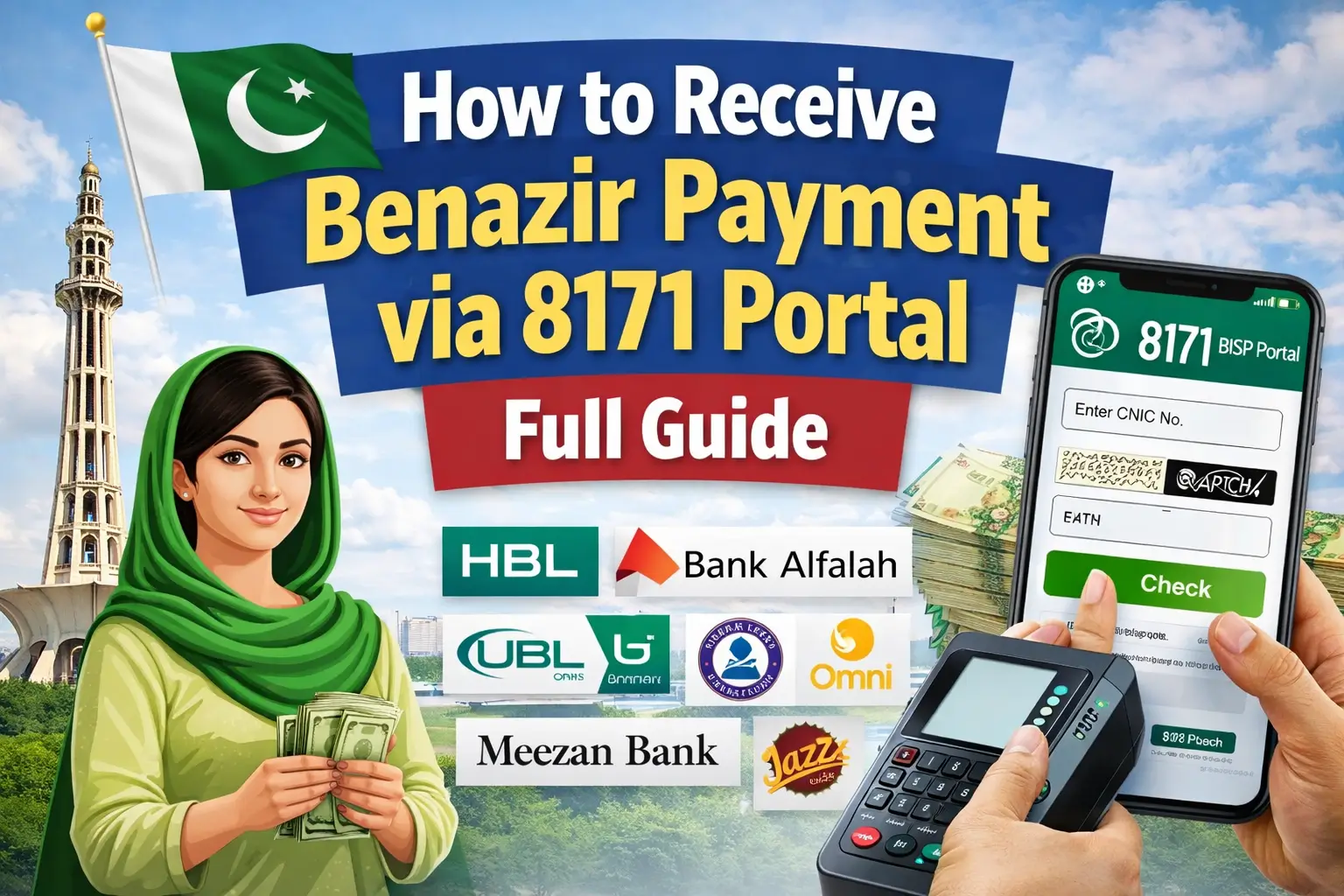

How to Receive Benazir Payment via 8171 Portal 2026 Guide, Wondering how to receive your Benazir payment through the 8171 portal in 2026?

This complete guide explains how to check eligibility, confirm payment, and safely collect BISP funds anywhere in Pakistan using official channels.

What Is the 8171 Portal and Why It Matters

The 8171 web portal is the official digital platform of the Benazir Income Support Programme.

It allows registered beneficiaries to check eligibility, payment status, and disbursement details online without visiting offices.

Key Purpose of the 8171 Portal

- Transparency in payments

- CNIC-based verification

- Reduced fraud and deductions

- Easy access for rural and urban families

8171 Portal Overview (Quick Table)

| Feature | Details |

|---|---|

| Portal Name | 8171 BISP Web Portal |

| Official Website | 8171.bisp.gov.pk |

| Main Use | Payment & eligibility check |

| Verification | CNIC via NADRA |

| Languages | Urdu & English |

| Access | Mobile, tablet, computer |

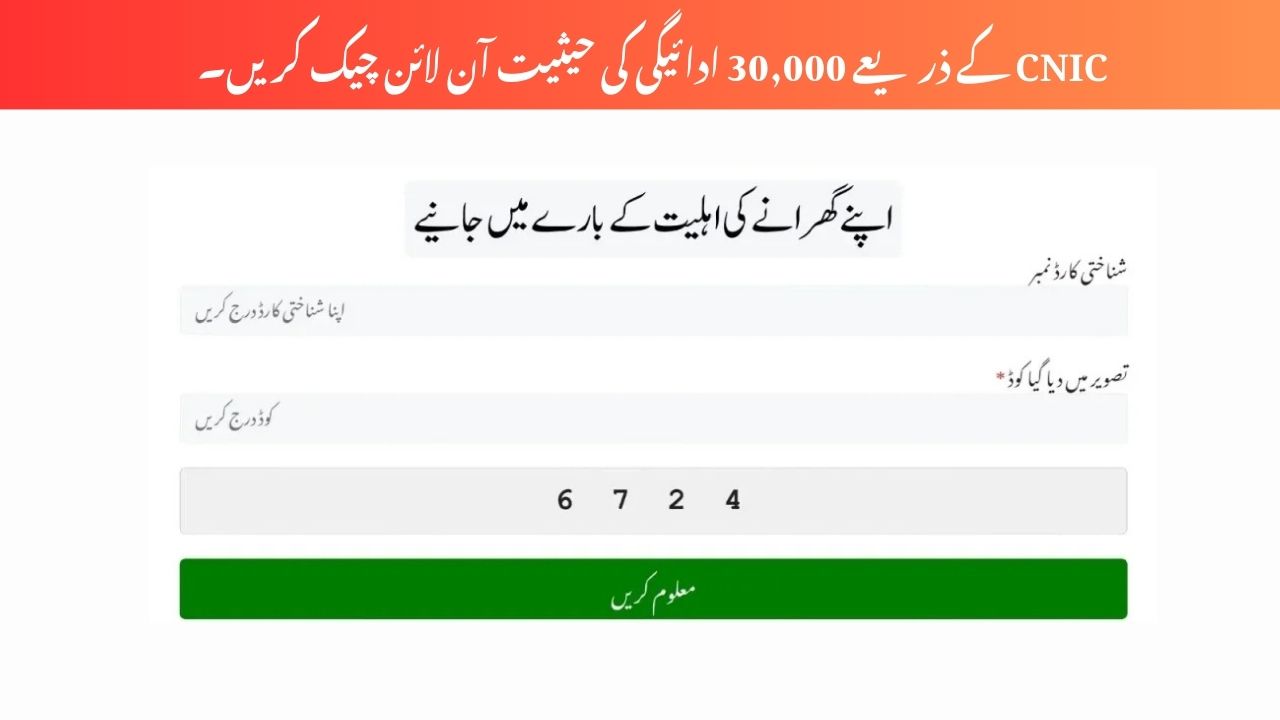

Step-by-Step: How to Receive Benazir Payment via 8171 Portal

Step 1: Visit the Official Website

Open 8171.bisp.gov.pk only. Avoid fake links or agents.

Step 2: Enter Your CNIC

- Enter 13-digit CNIC (without dashes)

- Fill captcha code

- Click submit

Step 3: Check Eligibility & Payment Status

The portal will show:

- Eligible or not eligible

- Payment amount

- Current payment phase

Step 4: Wait for 8171 SMS

If payment is released, you will receive an official SMS from 8171 confirming:

- Amount

- Payment channel

Step 5: Collect Payment from Authorized Channel

Visit the assigned bank or agent with:

- Original CNIC

- Registered SIM

- Biometric verification

Step 6: Confirm Payment on Portal

After collection, recheck status to ensure it shows Paid.

BISP Bank Partners for 2026 Payments

| Bank / Channel | Payment Method | Coverage |

|---|---|---|

| HBL Konnect | Biometric agents / ATM | Punjab, Sindh |

| Bank Alfalah | Cash withdrawal | Sindh, Balochistan |

| UBL Omni | Agent-based | KP, GB |

| Meezan Bank | Pilot payments | Selected cities |

| Mobilink Microfinance Bank | Digital wallet | Urban areas |

Common Problems & Easy Solutions

CNIC Not Verified

Expired or incorrect CNIC can delay payment. Update it through NADRA.

Biometric Verification Failed

Try another device or visit BISP office for manual verification.

No SMS from 8171

SMS delay is common. Always check status directly on the portal.

Payment Marked Paid but Not Received

System syncing may take time. Contact district BISP office.

Benefits of Using 8171 Portal for Benazir Payments

- Online CNIC verification

- No unnecessary travel

- Nationwide access

- Biometric security

- Reduced corruption

Documents Required Before Visiting Payment Center

- Original computerized CNIC

- Registered SIM number

- 8171 SMS (if received)

- Optional payment screenshot

Role of NADRA Verification in BISP Payments

In 2026, NADRA verification is mandatory. Household data, CNIC validity, and family records are cross-checked to prevent:

- Duplicate payments

- Fake registrations

- Ineligible disbursements

Any mismatch may delay or stop payment.

How to Report Fraud or Illegal Deductions

If you face deductions or fraud:

- Call BISP Helpline: 0800-26477

- Visit nearest BISP Tehsil Office

- Submit complaint via 8171 portal

Always keep payment receipt as proof.

Tips to Avoid Scams

- Trust SMS only from 8171

- Never share CNIC or fingerprints

- Do not pay agents any fee

- Report suspicious activity immediately

FAQs

How can I check BISP payment through CNIC?

Visit 8171.bisp.gov.pk and enter your CNIC number.

What if I don’t receive SMS from 8171?

You can still check payment status online anytime.

Is biometric verification mandatory?

Yes, for security and fraud prevention.

Can someone else collect my payment?

No, only the CNIC holder can receive payment.

Which banks pay BISP money in 2026?

HBL Konnect, Bank Alfalah, UBL Omni, Meezan Bank, and Mobilink.

Conclusion

Receiving your Benazir payment through the 8171 portal in 2026 is now safer, faster, and more transparent. With CNIC-based verification, biometric security, and multiple banking partners, beneficiaries can access funds without confusion.